Payments built for vertical

SaaS platforms

We help you build a better product by adding payments to your platform. Offer seamless experiences to your customers while increasing engagement and conversion.

Embedding payments doesn’t have to be difficult — we handle the complex stuff

We take care of the end-to-end payments technology, compliance, risk and onboarding so you don’t have to. We are there to help you grow your business through payments.

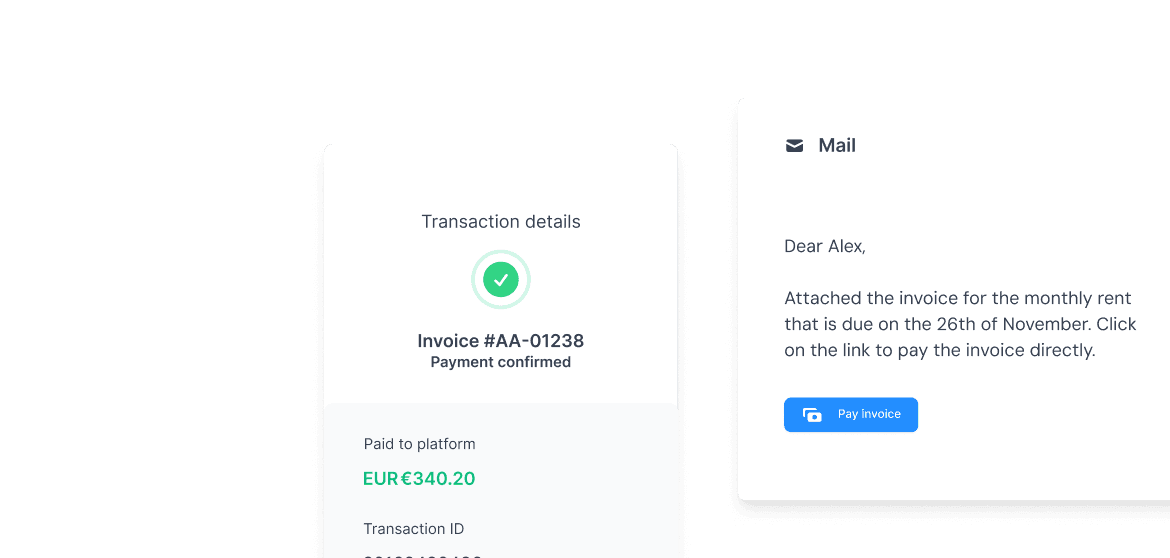

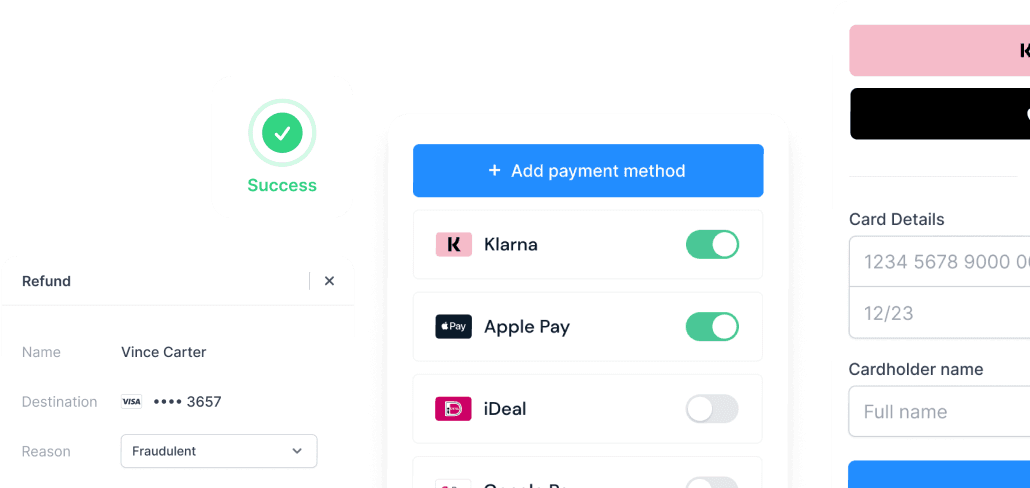

Accept all payments

Grow your revenue and save costs by accepting local payment methods, cards and account-to-account payments.

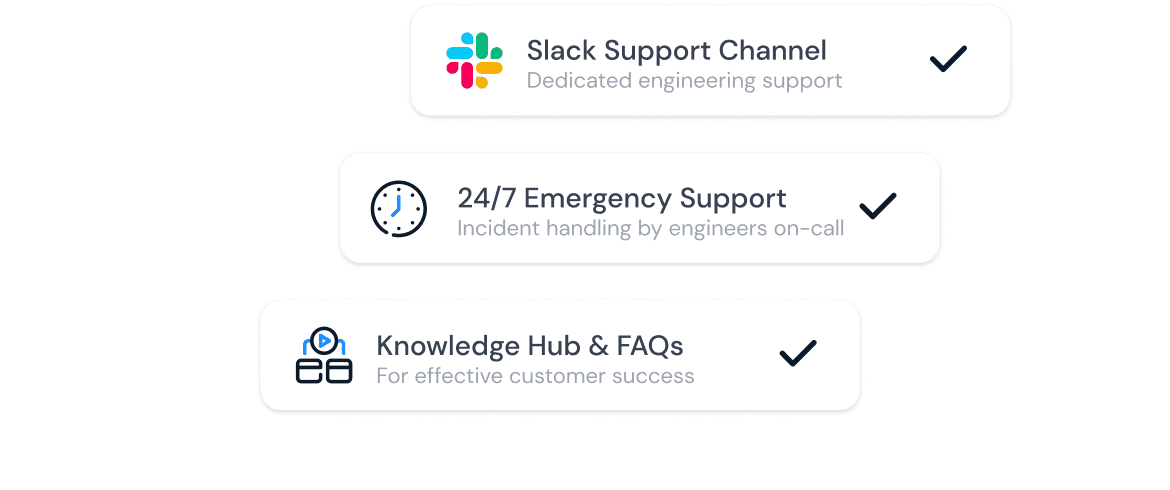

First-class customer support

Customized payment support — your way, your choice. Full service or DIY, we got you covered.

Integrate embedded payments within 14 days

Reduce development time with low-code payment components or use our API to build your own.

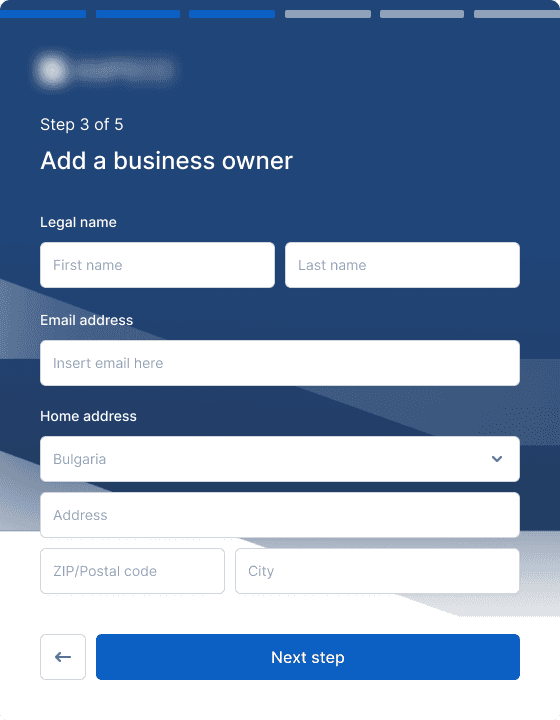

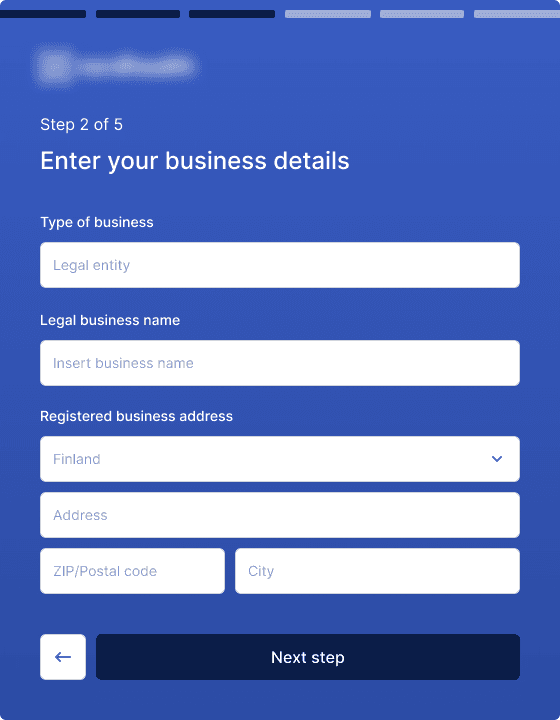

We take care of customer onboarding

Don’t worry about KYC and KYB - we got you covered. We ensure onboarding happens in a compliant manner and we keep fraudsters at bay.

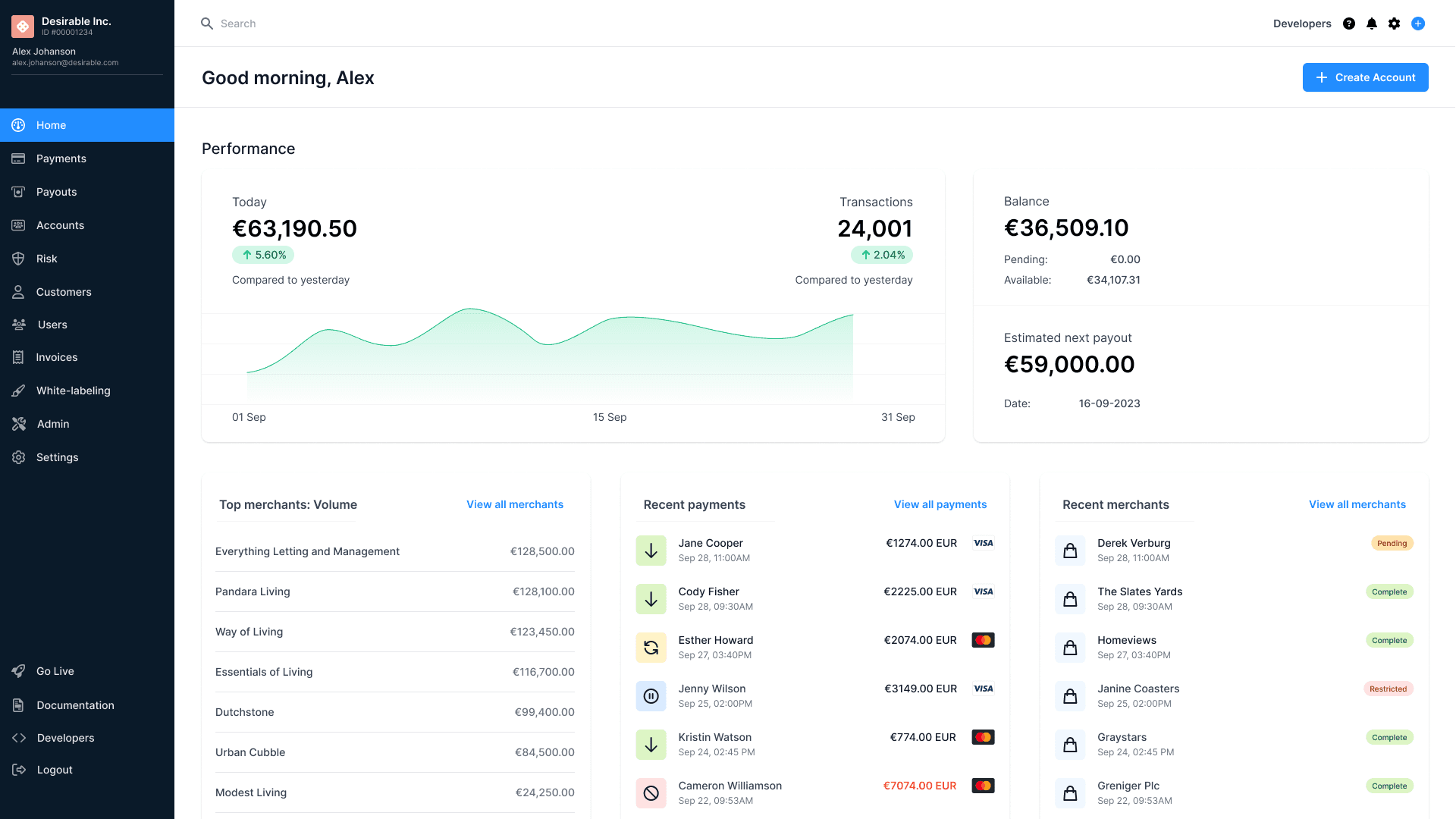

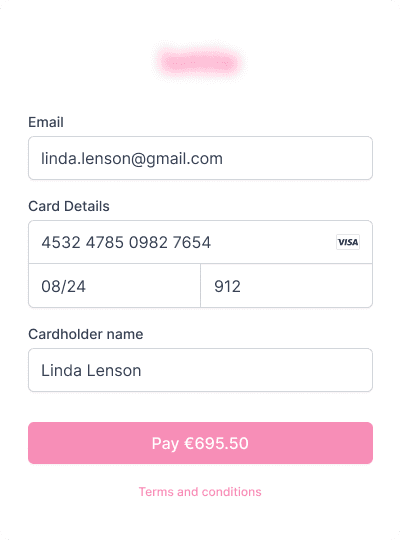

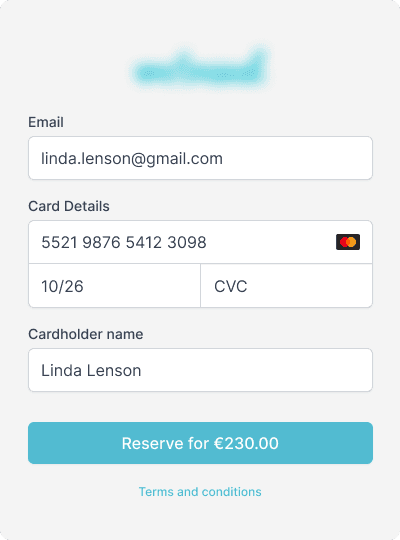

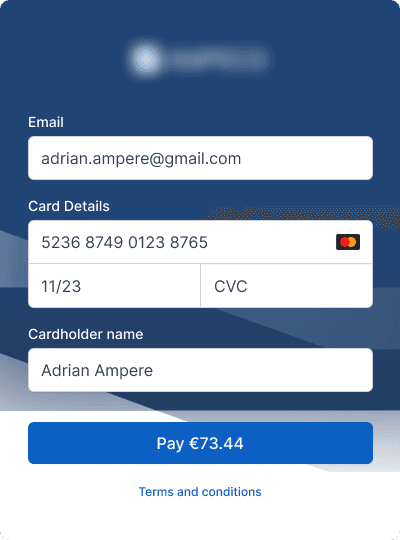

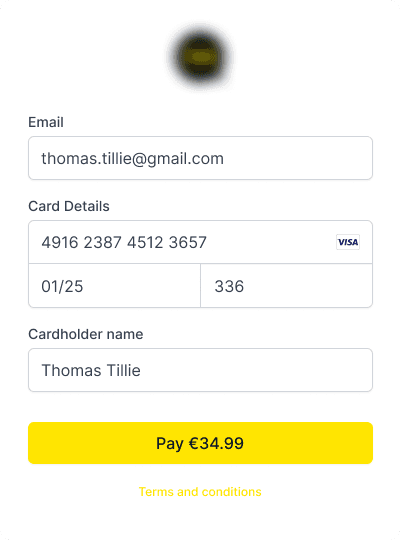

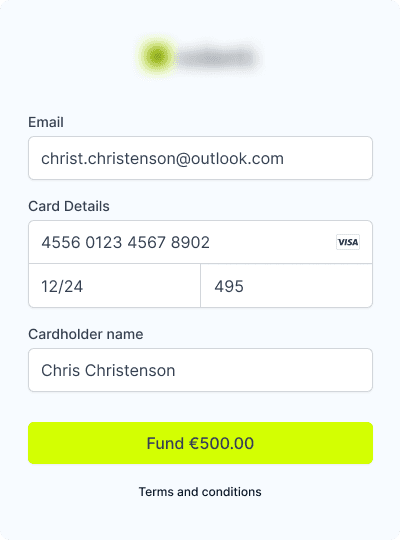

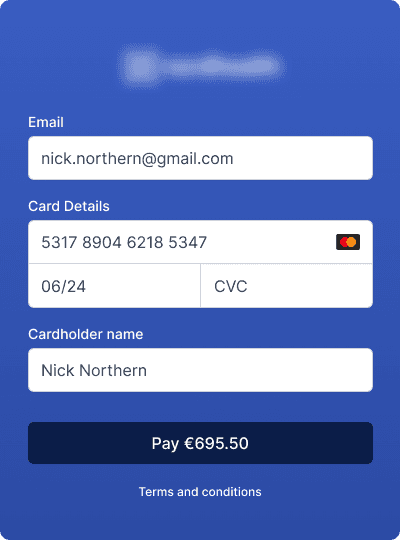

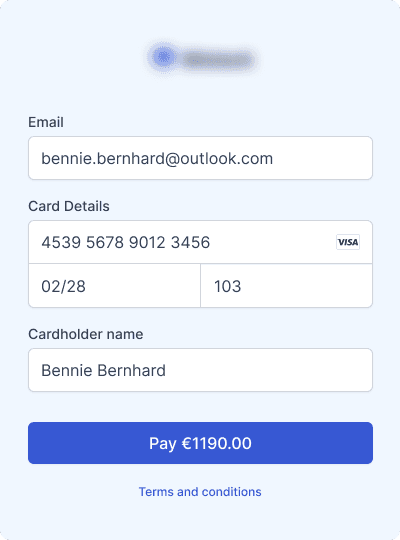

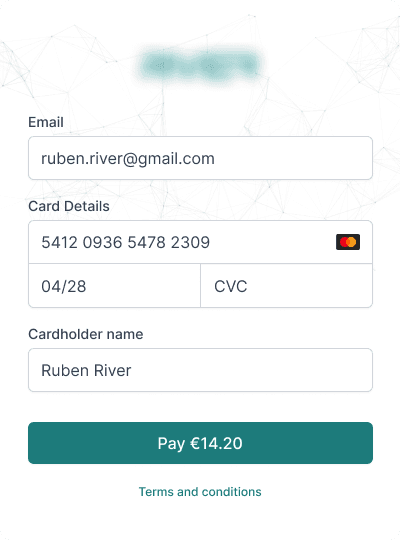

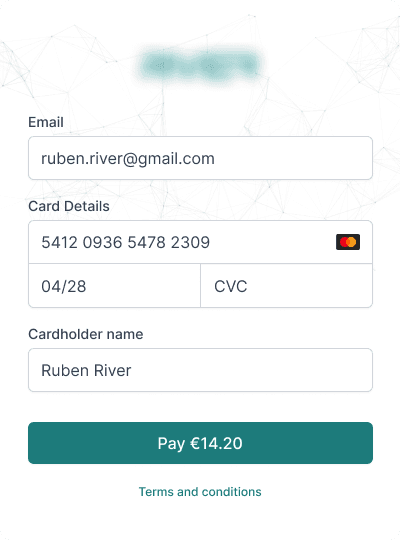

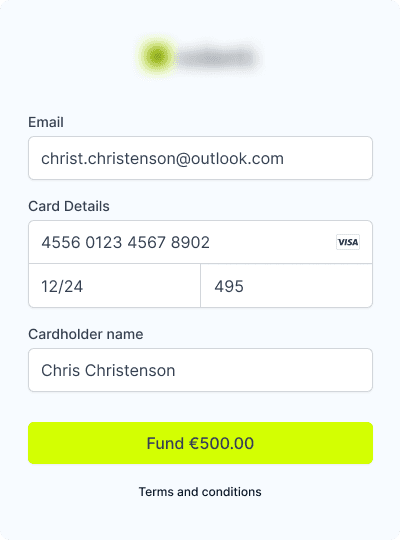

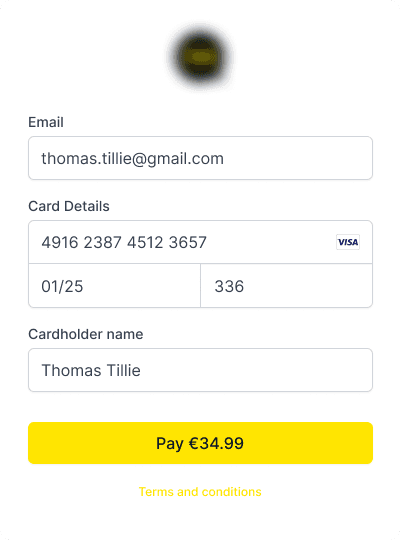

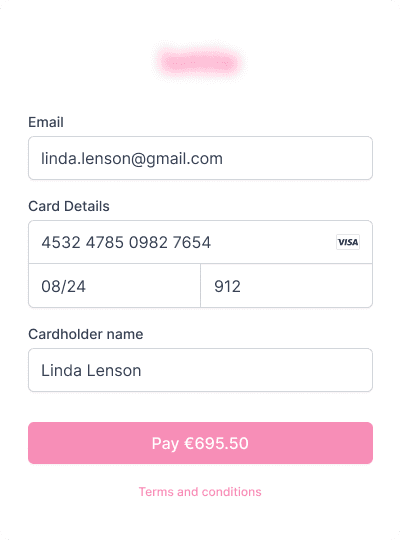

White-label embedded payments tailored to your brand

All of our payment components can be easily tailored to your brand. This provides your customers with a recognisable and trusted experience that will boost loyalty and increase revenue.

Manage organizational complexities with ease

Our Hive functionality will make reporting, reconciliation, payouts and pricing flawless, not matter the complexity of the organization.

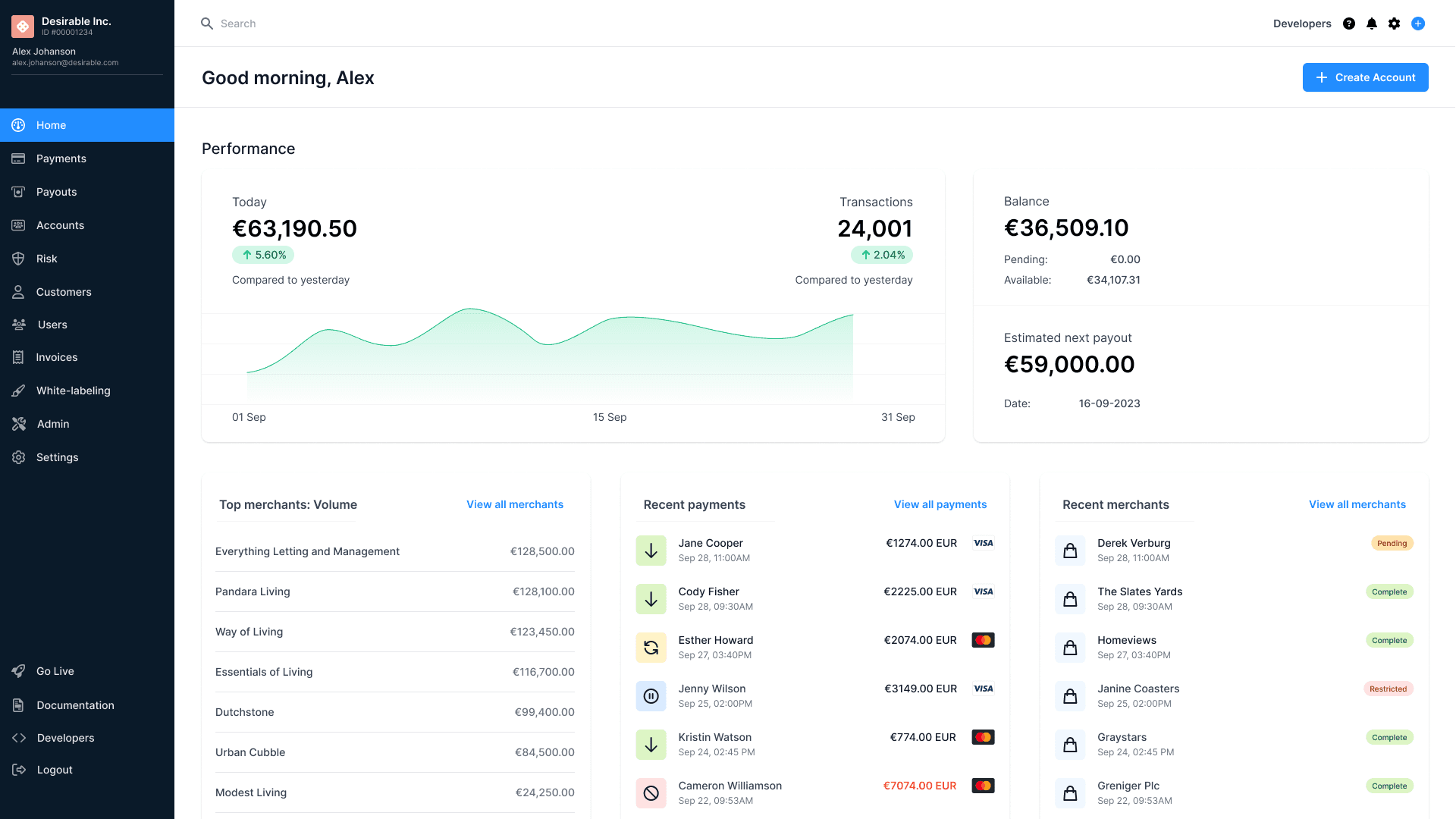

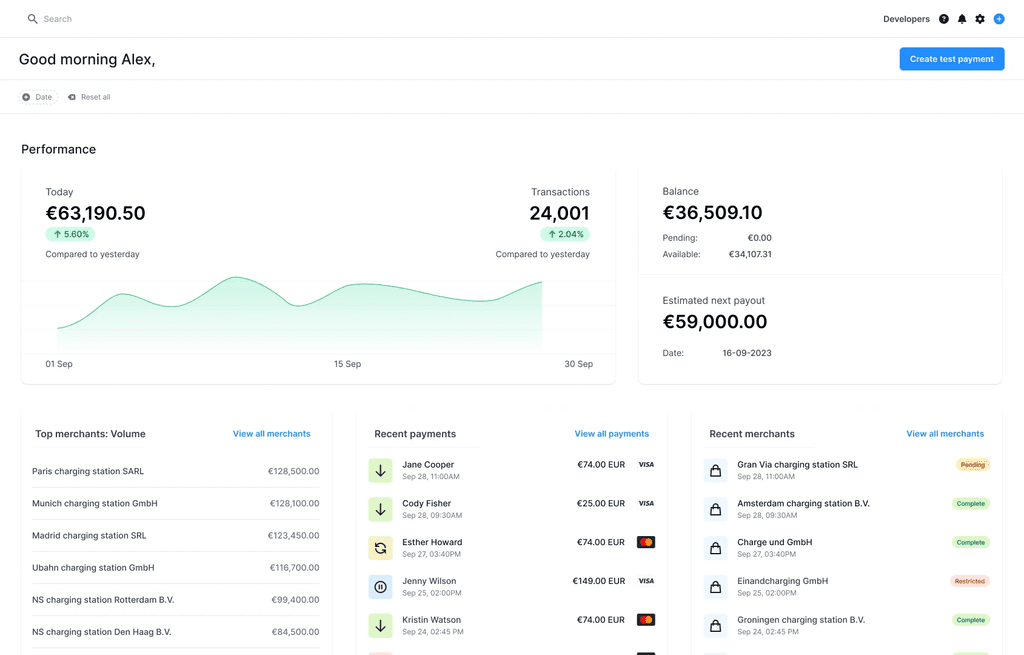

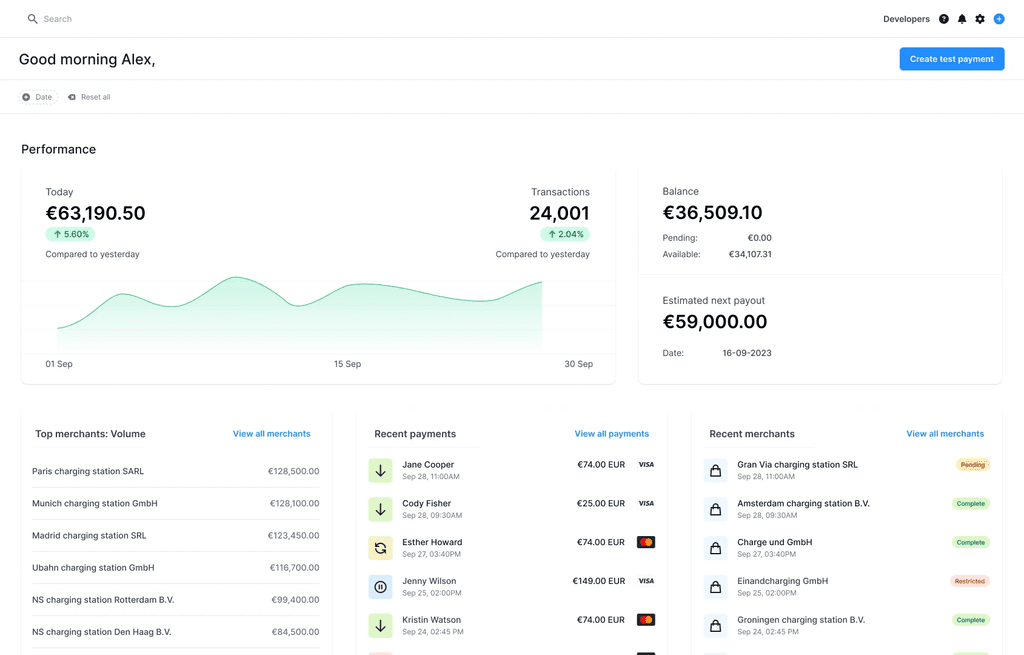

Grow and scale financial reconciliation and reporting

As businesses grow and adapt, their financial reporting needs also develop. Keep up with the ongoing shifts via our adaptable accounts.

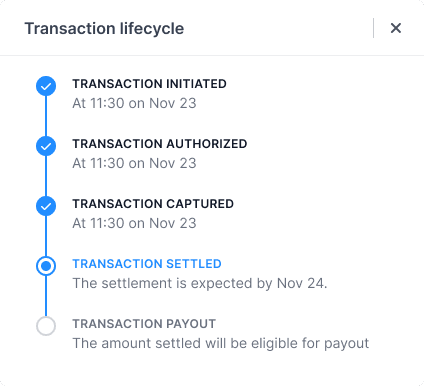

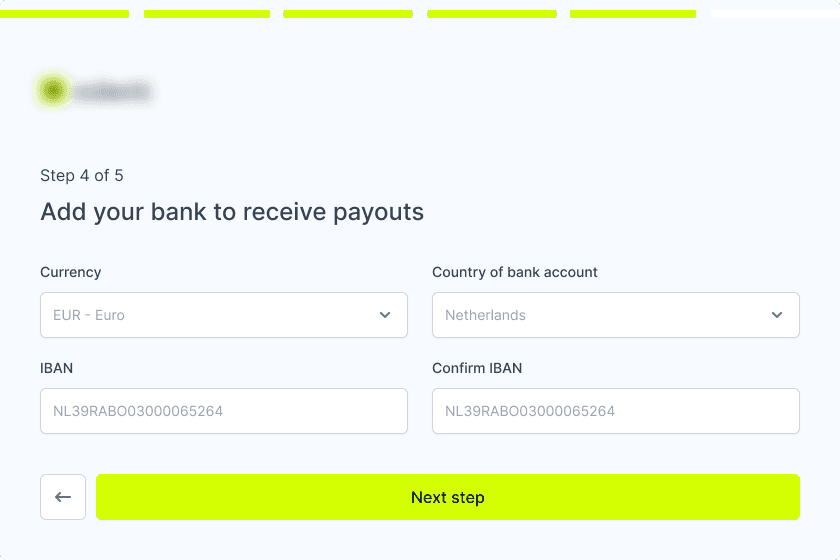

Faster and predictable payouts

Streamline payouts by scheduling, customizing, splitting or paying out in bulk. You can conveniently set up the frequency of payouts across the different organisations that you will power to match their preferences

Fine-tuned monetization of services

You can price every service towards your customers your way. Pricing can be shared for accounts, groups or apply to specific entities or countries. This can be specified even on a transactional level.

Ledgers for real-time bookkeeping

Through the use of multiple ledgers and virtual accounts we provide you with accurate insights on incoming and outgoing payments. Enabling you to service the most complex of use cases.

Grow and scale financial reconciliation and reporting

As businesses grow and adapt, their financial reporting needs also develop. Keep up with the ongoing shifts via our adaptable accounts.

Faster and predictable payouts

Streamline payouts by scheduling, customizing, splitting or paying out in bulk. You can conveniently set up the frequency of payouts across the different organisations that you will power to match their preferences

Fine-tuned monetization of services

You can price every service towards your customers your way. Pricing can be shared for accounts, groups or apply to specific entities or countries. This can be specified even on a transactional level.

Ledgers for real-time bookkeeping

Through the use of multiple ledgers and virtual accounts we provide you with accurate insights on incoming and outgoing payments. Enabling you to service the most complex of use cases.

Grow and scale financial reconciliation and reporting

As businesses grow and adapt, their financial reporting needs also develop. Keep up with the ongoing shifts via our adaptable accounts.

Faster and predictable payouts

Streamline payouts by scheduling, customizing, splitting or paying out in bulk. You can conveniently set up the frequency of payouts across the different organisations that you will power to match their preferences

Fine-tuned monetization of services

You can price every service towards your customers your way. Pricing can be shared for accounts, groups or apply to specific entities or countries. This can be specified even on a transactional level.

Ledgers for real-time bookkeeping

Through the use of multiple ledgers and virtual accounts we provide you with accurate insights on incoming and outgoing payments. Enabling you to service the most complex of use cases.

Grow and scale financial reconciliation and reporting

As businesses grow and adapt, their financial reporting needs also develop. Keep up with the ongoing shifts via our adaptable accounts.

Faster and predictable payouts

Streamline payouts by scheduling, customizing, splitting or paying out in bulk. You can conveniently set up the frequency of payouts across the different organisations that you will power to match their preferences

Fine-tuned monetization of services

You can price every service towards your customers your way. Pricing can be shared for accounts, groups or apply to specific entities or countries. This can be specified even on a transactional level.

Ledgers for real-time bookkeeping

Through the use of multiple ledgers and virtual accounts we provide you with accurate insights on incoming and outgoing payments. Enabling you to service the most complex of use cases.

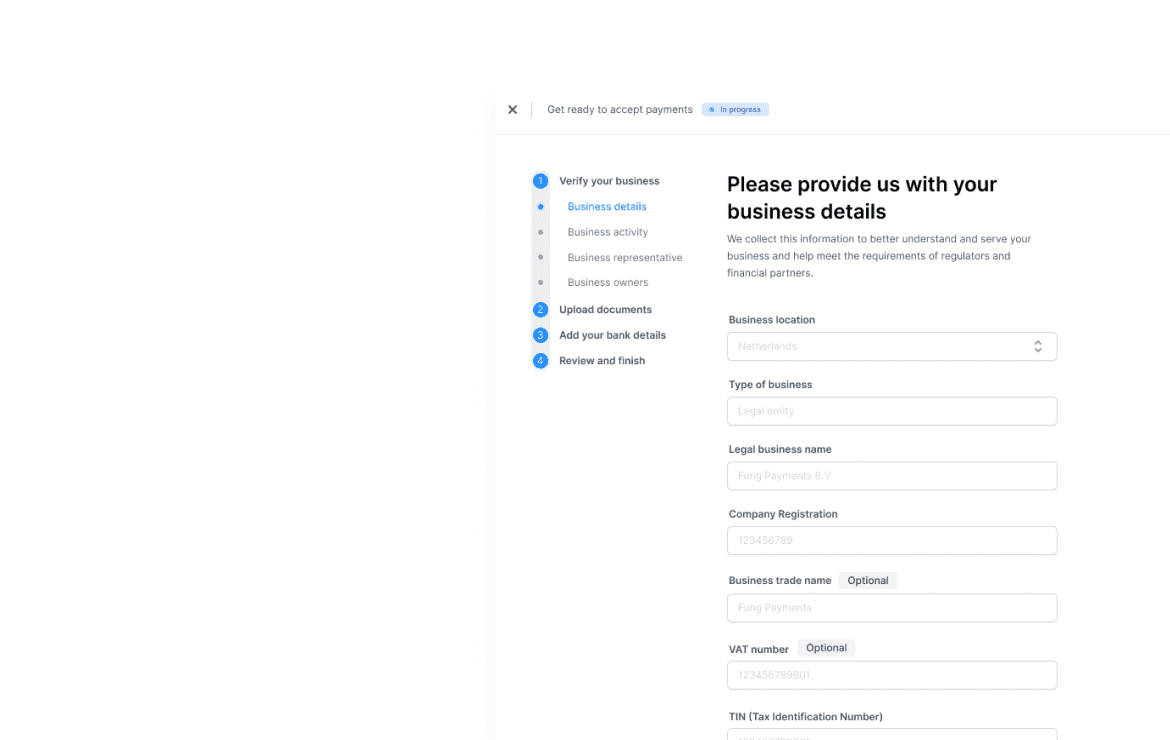

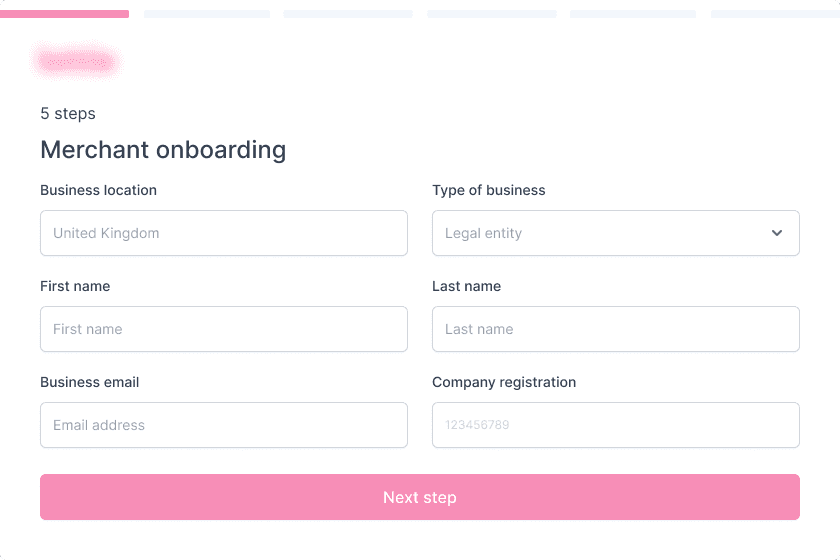

Automate and personalize your merchant onboarding

Streamline your merchant onboarding with hosted onboarding forms styled in your brand. Alternatively, use our APIs to create a tailored onboarding process to best fit your platform.

Safe and secure — we handle the complex stuff.

As a licensed and regulated financial institution we take care of the end-to-end payment flows, so you don’t have to. This way you can focus on building a better product for your customers.

Merchant onboarding

ISO 27001 Compliant

Licensed Financial Institution

Ready to get started?

Let’s discuss how you can make the financial lives of your merchants better. Or create a sandbox account and start integrating!