Embedded Payments for Financial Management Platforms

Oct 18, 2023

The struggle with AP/AR complexity and fragmentation

Paying invoices or receiving payments shouldn’t be a drain on company time and resources.

But both paying suppliers and getting paid remain the most labour-intensive and time-consuming finance functions in the eyes of CFOs and other execs surveyed by the Institute of Finance and Management (IOFM).

Whether it’s onboarding and registering suppliers, making payments, or reconciling transactions, AP/AR staff are bogged down with manual tasks that take them away from the things they were hired to do.

The root of the problem is the hodgepodge of point solutions and closed-loop networks that most AP departments use to pay suppliers. Each of these systems comes with its own logins and passwords, user authentications, file formats, and proprietary integrations.

As a result, friction and silos abound.

The rise of Embedded Payments in the financial management market

Every month, €27 billion in payment volume is being processed for business transactions (account payables/receivables) across Europe. Accounting software platforms have evolved to capture that volume and streamline the payment process. This isn't a fleeting trend – it's a transformation solidifying as the industry benchmark.

Clients, be they small business owners, finance managers, or individual professionals, are leaning towards an integrated solution that manages all their business-related payments. There's a diminishing appetite for navigating to separate platforms for different financial tasks. The era of manually recording transactions or using multiple platforms for financial management is waning; professionals seek a consolidated payment and accounting experience.

A J.D. Power study indicates that an impressive 70% of end-users, ranging from business owners to accountants, prefer to manage all business-related financial transactions within a single platform. They want to handle invoicing, expense tracking, and even one-time financial charges, all under one roof.

This evolving customer preference underscores a golden opportunity: embed payments directly within your accounting software. Many businesses juggle manual payment reconciliation or liaise with multiple 3rd-party gateway providers to find the optimal fit.

By offering a unified platform for both payments and financial management, you can

Vastly streamline the onboarding process;

Minimize operational complexities and;

Elevate the user experience of your customers.

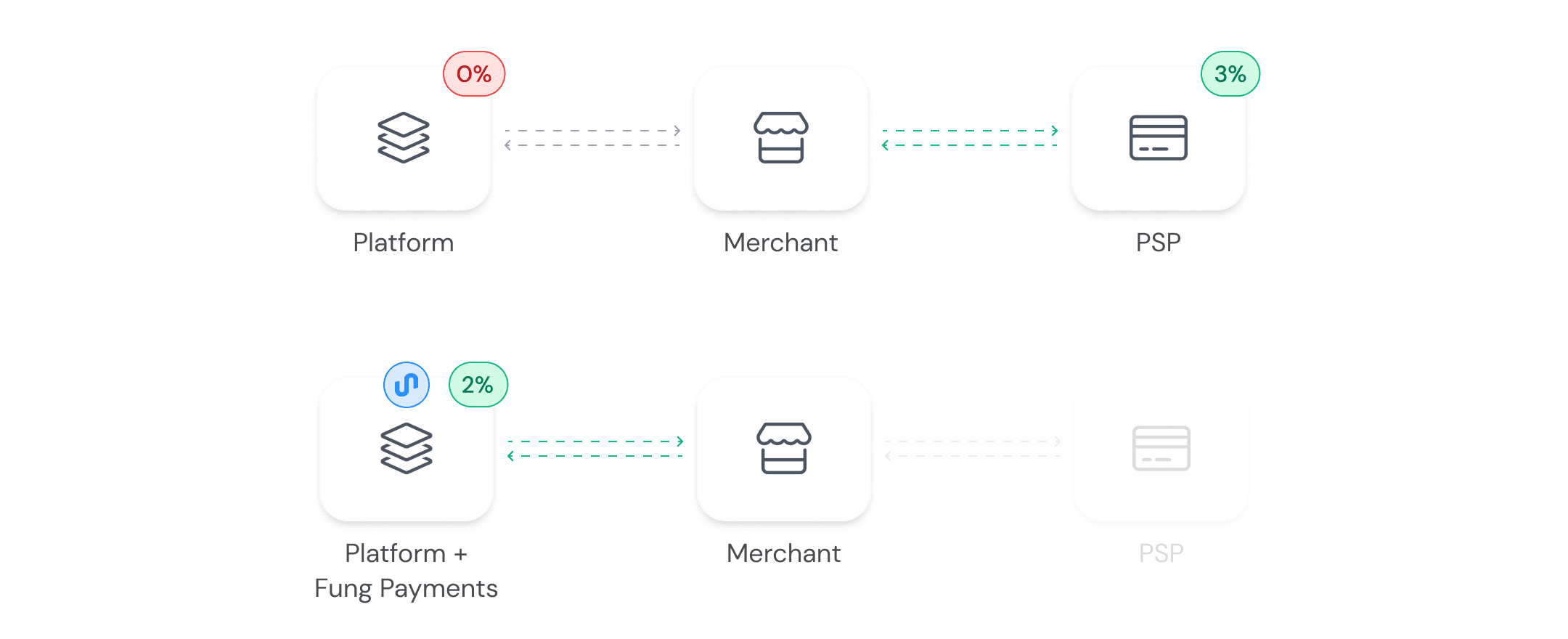

Seizing the PayFac opportunity: AR/AP payment automation

A Payment Facilitator or PayFac is a merchant of record who allows sub-merchants to process transactions under their master merchant account. The PayFac model is revolutionizing the way payments are processed, especially for businesses like yours that deal with a multitude of sub-merchants (e.g. finance teams, small businesses, freelancers, financial consultants, etc.). Implementing the PayFac model could significantly simplify your transaction process and offer significant opportunities for revenue expansion.

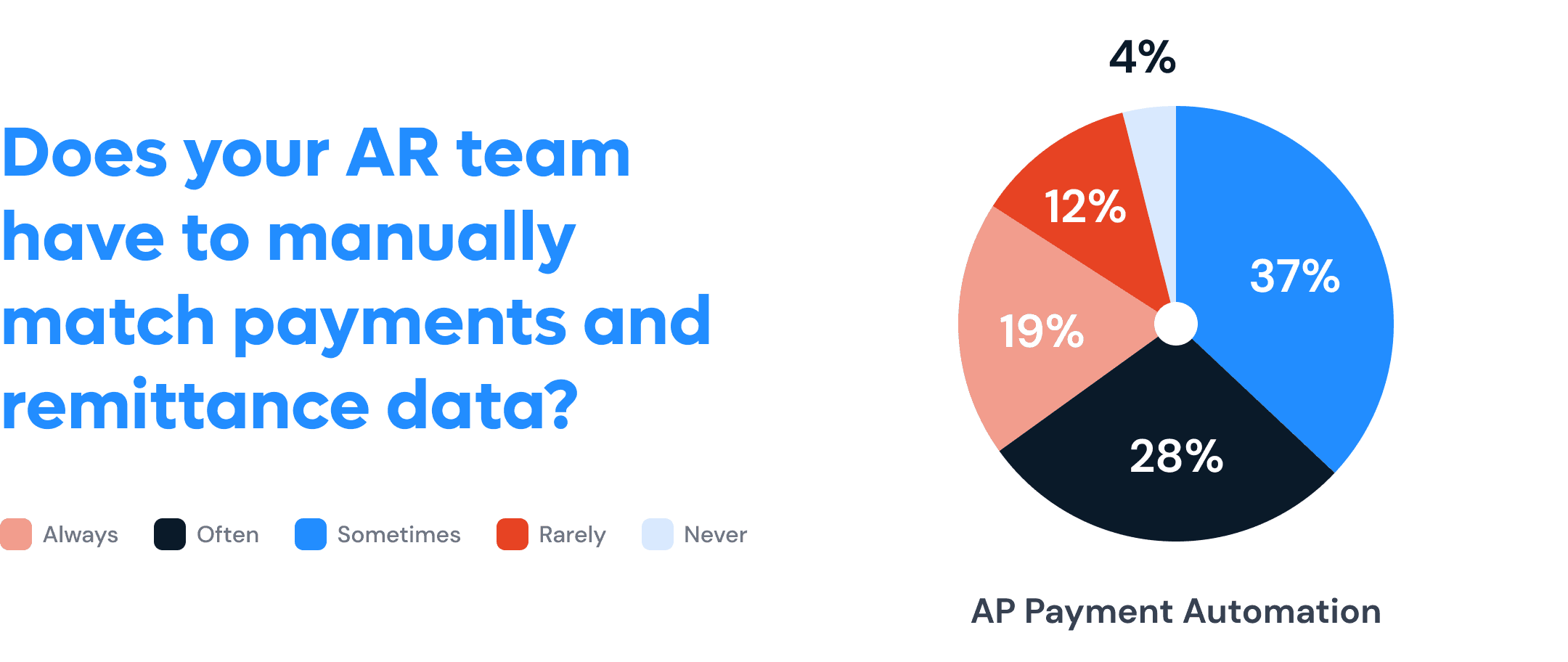

Businesses and financial managers are consistently opting for accounting software platforms aligned with their operational needs. In a recent study asking small businesses about the most valuable features of accounting software, the top result was streamlined payment processing for AP/AR. Why? Because chasing overdue invoices is a draining and often times manual task. For professionals who bear the responsibility of managing finances and ensuring timely payments, delayed transactions can impede cash flow – and delay potential financial growth as well.

Unlocking a superior user experience for your customers

1. Embed payment links for account receivables automation

Offering your customers the best pay-by-link and checkout experience to receive payments of any type (e.g., SEPA, bank transfer, Open Banking, cards, local payment methods like iDEAL or Sofort), using any payment rail, and from any originating bank account.

2. Trigger bulk payouts to suppliers (account payables automation)

Streamline payouts by scheduling, customizing, splitting, or paying out in bulk. Your customers can conveniently set up the frequency of payouts to match their billing cycles or customer preferences.

3. Automate real-time reconciliation capabilities with virtual IBANs

Make it easy to manage invoice reconciliation by assigning one virtual IBAN per invoice. This way, you can automatically match incoming payments with each invoice, know exactly whether the payment has been made, and send automatic payment reminders.

4. Automate customer onboarding and verification

Registering is done digitally and in real-time. We verify legal entities and the beneficial owners of the business. This makes the process faster and simpler for yourself and your customers and provides the peace of mind that your counterpart is independently verified.

Amplifying profits and your metrics

1. New revenue stream on top of the software subscription

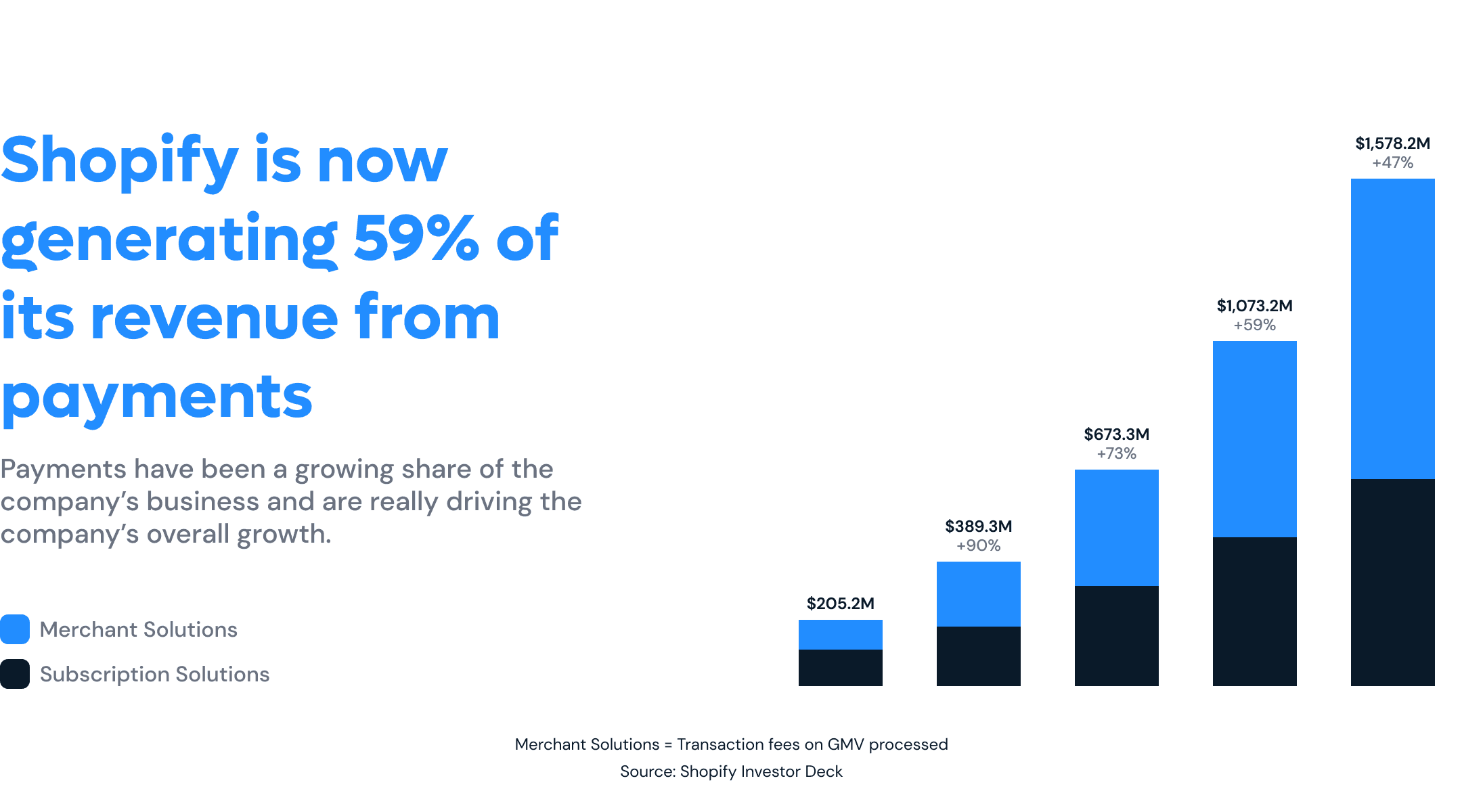

You stand to gain from transaction fees every time a business processes an invoice or transaction through your software. Considering the expanding usage of accounting platforms and the vast sums of funds being transferred, this could usher in a significant new revenue stream for your company.

2. Higher ARPC (average revenue per customer)

Highly relevant with your larger customers that generate more sales, your transaction fees on payments could be far above and beyond the sticker price of your SaaS subscription.

3. Higher customer retention

Eliminates the need for businesses or financial managers to set up and maintain a direct relationship with a third-party payment gateway, gives them access to all payment methods (e.g. Cards, SEPA, iDEAL, Open Banking, etc.) at low processing rates, and allows you to cross-sell additional solutions to your customer base like instalments.

Why working with Fung is easy

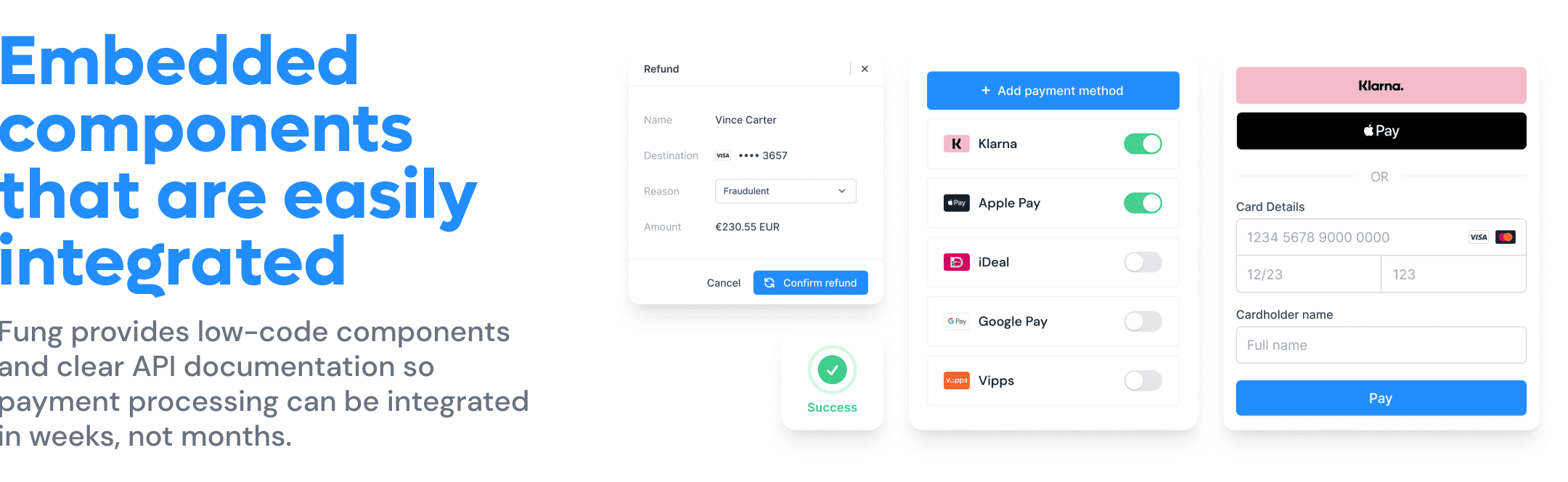

Build and launch Fast — Our robust API architecture enables your team to build, innovate and launch financial products easily.

Full-service platform — Next to the core payment services provided, you benefit from management and reporting tools, administrative workflows, as well as customer service & support.

Free from regulatory burdens — With our integrated compliance and KYB solutions, your team can focus on building your business and leave risk management and compliance to us.

Reliable and secure platform — We are a regulated entity and certified to the highest compliance standards.